People with large filecoin holdings ![]()

Wouldn’t worry. Lots more liquidity = price pumping. ![]()

Didnt sell before being in the wild id bet. ( live )

Were not there yet.

I’ll help them out if they do ![]()

well that escalated quickly…

In respect to Fiat. You show the BTC without considering what BTC has done. While that shows some information it does lack the context of what affects people the most.

The context is that Maid was traded vs BTC most of its history.

The context you replied to was MAID vs Fiat.

History was traded against BTC on an exchange but people were taking the price of BTC and looking at it in that context, while others against BTC only. So in fact historically both vs BTC and vs Fiat. The above conversation though had the context of vs Fiat which you replied to

Where is this info tracked?

Im assuming here.

The best metric actually is or will be BTC as the dollar is inflating much faster. Everything is getting re-priced in BTC.

When talking of eMAID though it is more tied to fiat than Omni was. Also for Omni it was more a case of one eye on BTC and one eye on BTC/fiat for many people. Of course some were only looking at BTC and others only fiat. Currently though the value of (e)MAID is what its worth or how much must I pay to get.

But when people are talking of eMAID vs $ then thats what they are talking about

Really?

6-12 months ago we looked mostly at MAID-BTC. Now anybody who is trading looks primarily at eMAID-USDT.

And again, a big thank you to all who put the hard hours into making eMAID possible.

I think there’s no right answer.

A general divide is to view either the real value (which depends on what each individual decides they want to buy with a token, or some unit of exchange etc), or a proxy unit of exchange that people use habitually and have a sense of even though its actual purchase power varies (as all proxies do, not just fiat).

Most people are paid and spend and think in their local fiat, so for most that’s the easiest measure and their idea of value will be tracked using their most familiar fiat unit. It’s pretty good because fiat value changes slowly enough for people to adjust their perceptions. Tracking using that over long periods needs to take those changes into account, but not many will bother to do that.

For others, a different proxy may be preferred, such as bitcoin. But given the wild fluctuations there I don’t find that a useful proxy myself.

For a small minority it will be their particular subjective or calculated view of value - based on the things they buy and the value they put on them rather than a single proxy. They are the real nerds, but for most it’s down to how it makes people feel.

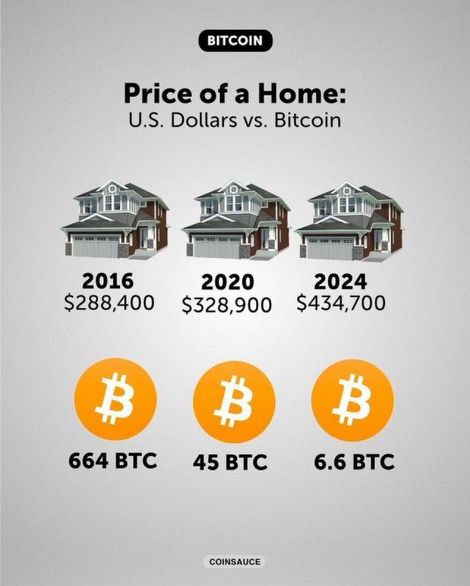

We are all free to look at any trading pair we like. My point is that true value is better priced in btc than the dollar. If we make a new high in $ it will be great, but in reality we can buy less things with that MAID than we could at the previous new all time high. True value is better priced in a hard asset like BTC, gold or property.

This much is true ![]()

Shame about the rest of it ![]()

Just kidding - a rising tide floats all boats and I hope BTC continues to do well. I was out at the shops there and nowhere did I see anything priced in BTC…

As for houses, well Im not in the market - not until postLambo anyway and a nice red sandstone pile with an observatory dome on the west wing comes on the market - and I bet its priced at OO£650k not some qty of BTC that [c|w}ould fluctuate wildly in the days it took to finalise the deal.

As an aside, I was deeply involved in the first crypto house sale in Scotland - 5-6yrs ago. Just across from the Lauriston, it was the first and only such sale to date AFAIK

What happened was Person A bought £75k worth Scotcoin from person B on the Tuesday for cash - On Wednesday, person B offered a small flat to person A for a qty of Scotcoin remarkably similar to the amount transacted the day before. Persons A and B were major investors in Scotcoin, had known each other for 20+yrs and had long planned to sell this house as a student flat for person B’s son. I was there to hold hands, make sure they didnt forget their 12 words etc etc - oh and make sure the reporter from the Record was in attendance for this piece of pure theatre

But we got the headline and a quarter of page 4 with the first crypto house sale in Scotland.

Maybe in happens out on the West Coast or Florida but never heard of anything else close to home.

Maybe I dont pay enough attention these days…

That’s fantastic that you were part of that house sale.

When I say everything is being re-priced in BTC i think you are misunderstanding me. I don’t mean shops and estate agents are all looking to start pricing in BTC. I’m saying as btc rises and becomes an established mainstream asset / digital gold / currency, and because it is the hardest money we have ever known, all the worlds goods will eventually use the hardest asset to understand the true value of them. Is it best to measure something with a ruler that is fixed or one that is constantly expanding?

The best person to listen to about this topic is the excellent Jeff Booth:

https://www.youtube.com/watch?v=G2vAm2hfW9U

This is an interesting website:

PricedInBitcoin21

"Abundance in money = scarcity everywhere else.

That scarcity and the mistruths about where it originates (the manipulation of money) leads to conflict.

Scarcity in money = abundance everywhere else.

There is a transition path, but it requires honesty." - Jeff Booth

Have you heard about some guys printing billions in their garage for I owe you receipts, aka Tether, or has Bitcoin become affiliated with Viagra?