Okay say we take Safecoin and make that the perpetual coin of the SAFE network as seen in the videos above. We can then use the Safecoin as a commodity in a sort of setup where every user of SAFENET has a personalized bank from the start. They should have the ability to issue their own currencies from the beginning backed by Safecoins.

Just doing that would give Safecoins a value as the unit of measurement. It’s something we could use in our promises to pay in Safecoin via collateral.

Trust in the sense you’re thinking about isn’t necessary because the contracts could be self enforcing. So there would be trust but the trust would be in the code and in the self enforcing contract rather than the behavior of the issuer. Once the deal is made they don’t control their Safecoin at that point (the escrow controls it).

At any time the buyer of their self issued credit currency can trade it back for Safecoin until the redemption date which would mean everyone would be able to get their money back prior to the redemption date simply by sending the currency back to the issuer and triggering the escrow to release the Safecoin to them. It’s no different from backing your self issued credit voucher by gold so that people can always get their worth in gold.

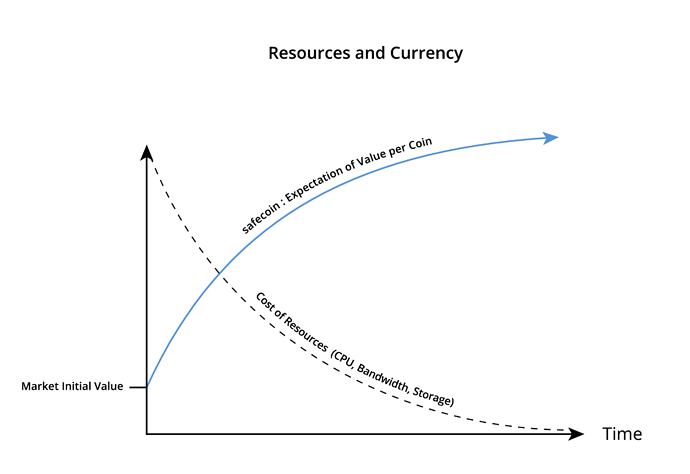

Would you accept Safecoins as a generic token of value? I would if I were running a business or doing science because I could always use more resources and if there is enough demand we can always sell it for Bitcoin and turn that into fiat.